In the ever-evolving landscape of private capital markets, 2024 presents a unique set of challenges and opportunities for private equity (PE) investors. As CIOs within PE organizations, your role is pivotal in ensuring successful exits. Let’s delve into key considerations and strategies tailored to your expertise.

Anticipated Developments in 2024:

Early indicators suggest a favorable outlook for the industry. The Federal Reserve’s potential execution of a soft landing, coupled with a stable labor market and moderating inflation, instills hope for rate cuts. As a CIO, stay attuned to these macroeconomic shifts—they directly impact your exit strategies.

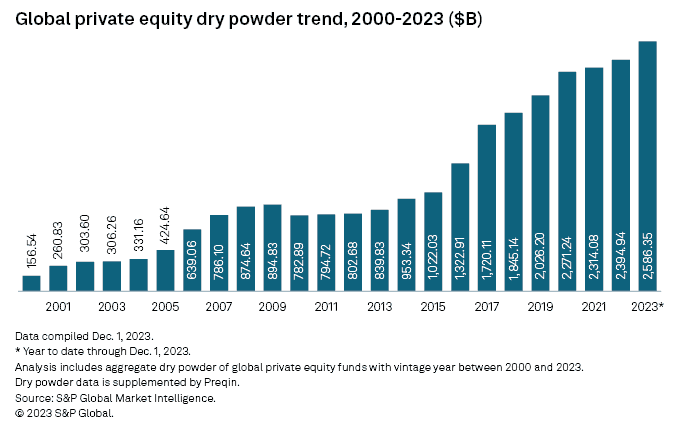

Navigating the Cash Conundrum

PE firms enter 2024 with substantial cash reserves, but certain sectors, particularly software, hesitate to engage in deals at valuations significantly below the 2020 and 2021 peaks. As a CIO, consider the following:

- Strategic Deployment: Optimize cash deployment by identifying software companies with growth potential. Look beyond traditional metrics—evaluate their technology stack, scalability, and alignment with your exit goals.

- Valuation Realism: Acknowledge that previous valuations may no longer hold. Collaborate closely with deal teams to assess fair valuations in the current interest rate environment.

- Deal Timing: Anticipate a surge in dealmaking as inflation subsides and interest rates decline. Be prepared to act swiftly when favorable opportunities arise.

Leveraging SaaSrooms for Exit Success

As a CIO, you understand the critical role of technology. SaaSrooms—a strategic tool—can enhance exit readiness and ensure profitability:

- Data-Driven Insights: Leverage SaaSrooms’ data analytics capabilities to assess portfolio companies objectively. Identify growth drivers, operational efficiencies, and areas for improvement.

- Collaboration Hub: SaaSrooms centralizes communication among stakeholders—PE teams, management, and advisors. Streamline due diligence, track progress, and address bottlenecks efficiently.

- Exit Narratives: Craft compelling narratives backed by strong data foundations. Highlight technology-driven value creation, scalability, and competitive advantages.

AI-Driven Process Automation: A Cost-Saving Imperative

In the pursuit of efficiency and cost savings, AI plays a transformative role:

- Automating Repetitive Tasks: AI-powered bots can handle routine tasks such as data entry, reconciliation, and report generation. By reducing manual effort, your organization can allocate resources strategically.

- Predictive Analytics: AI models analyze historical data to predict market trends, customer behavior, and investment opportunities. Use these insights to optimize portfolio decisions and exit strategies.

- Risk Assessment: AI algorithms assess risk factors, flagging potential pitfalls early. Whether it’s identifying underperforming assets or evaluating regulatory compliance, AI enhances due diligence.

- Operational Efficiency: Implement AI-driven workflows to streamline processes—from deal sourcing to post-acquisition integration. This efficiency translates to cost savings.

Conclusion

In 2024, CIOs play a pivotal role in shaping successful exits. Embrace the dynamic landscape, adapt to changing valuations, and harness technology strategically. With SaaSrooms as your ally and AI as your co-pilot, elevate your exit strategies and drive PE portfolio profitability.

Remember, as a CIO, your decisions impact the entire exit process. Stay agile, data-driven, and forward-thinking. 🚀💡